Nürtingen, 3 February 2025 – H.I.G. Capital is taking a significant stake in the HELLER Group. This partnership will ensure the success of the transformation and open up many new opportunities for HELLER in the areas of investment, efficiency improvement, product development and international market development.

HELLER CEO Dr. Thorsten Schmidt says: “The partnership with H.I.G. is a milestone for our company. H.I.G.’s additional financial resources and global network will enable us to more rapidly achieve our strategic goals. Our aim remains clear: to secure and expand our innovation leadership in the market to reach new industries and customers.”

New opportunities for HELLER: innovation, growth and global presence

The partnership with H.I.G. Capital represents a significant development step for HELLER and opens up numerous prospects for the future:

1. Investments in pioneering technologies

HELLER and H.I.G. plan to invest the additional funds in the development of innovative technologies. The focus will be on:

- Digitalisation and automation

The expansion of digital solutions will enable HELLER customers to organise their production even more efficiently and flexibly. These include artificial intelligence on the machine, the digital twin and other simulation and analysis tools, combined with the continued expansion of automation solutions for the networked production environment.

- Sustainable production technologies

HELLER will continue to invest in environmentally friendly and resource-efficient production technologies to meet the growing demand for sustainability. This also includes the development of energy-efficient machines and processes.

2. Expansion of the product portfolio

HELLER will expand its existing product portfolio to address new industries. HELLER’s high-precision machines are specifically designed to meet the needs of diverse industries, including mechanical engineering, aerospace, energy, defense, commercial vehicles and e-mobility (structural components). The integration of additional manufacturing modules and flexible production systems meets the increasing demand for customisation and batch size flexibility.

3. Expansion the global market presence

With H.I.G. Capital as a partner, HELLER will be able to continue its international expansion. The plan is to:

- Develop new markets

H.I.G.’s global network will give HELLER access to previously untapped markets and industries.

- Strengthen global sales

HELLER will continue to expand its sales and service subsidiaries to increase customer proximity in strategically important regions.

- Foster local partnerships

Regional partnerships and joint ventures will be used to provide customised solutions for specific market needs.

- Cooperate with industrial customers

Close cooperation with leading companies in a variety of industries will enable us to develop customised solutions.

4. Improving efficiency and competitiveness

H.I.G. brings extensive experience in operational improvement to companies. HELLER will benefit from this expertise to:

- Optimise processes

Targeted measures will be taken to make internal processes more efficient and increase the company’s agility.

- Increase competitiveness

Investments in state-of-the-art production methods and the digitalisation of internal processes will further increase competitiveness.

Comments on the partnership

Christian Kraul-von Renner, Managing Director of H.I.G. Capital, explains: “HELLER is a technology jewel. We are impressed by the engineering capabilities, the expertise of the workforce and the competence of the management. The company has been around for over 130 years and we are confident that it has a bright future ahead of it. We look forward to working with the Heller family and the management team to realise the full potential of this company. Our goal is to further strengthen HELLER’s role as a global leader in innovation and to expand the success of the company on a sustainable basis.”

Nicole Pfleiderer and Marc Heller, representing the fourth generation of the family owners, emphasise: “This partnership allows us to actively shape the company’s transformation while preserving our roots. Together with H.I.G., we are laying the foundations for sustainable growth and success.”

About HELLER

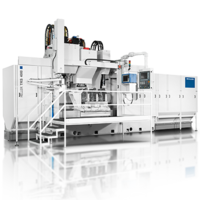

HELLER was founded in Nürtingen/Germany in 1894 as a small craft business. Today, the multinational group develops and produces state-of-the-art CNC machine tools and manufacturing systems for highly productive metalworking. Five production facilities in Europe, Asia and North and South America ensure a reliable supply to customers from many different sectors. In addition, HELLER is represented in all major markets with its own sales and service subsidiaries as well as qualified service partners. The HELLER product range comprises 4-axis and 5-axis machining centres, mill/turn machining centres, special-purpose and process machines, machines for crankshaft and camshaft machining as well as coating modules. The portfolio is supplemented by a modular range of services and an expanded spectrum of solutions for the digitalisation and automation of production.

About H.I.G. Capital

H.I.G. is one of the world’s leading alternative investment firms, with $67 billion in assets under management. Headquartered in Miami with U.S. offices in Atlanta, Boston, Chicago, Dallas, Los Angeles, New York and San Francisco in the United States and international offices in Hamburg, London, Luxembourg, Madrid, Milan, Paris, Bogotá, Rio de Janeiro, São Paulo and Dubai, H.I.G. specialises in providing debt and equity capital to mid-sized companies with a flexible and operationally focused, high value-added approach:

H.I.G. equity funds invest in management buyouts, recapitalisations and corporate carve-outs of profitable manufacturing and service companies that are in a phase of transition.

H.I.G. debt funds invest in senior and subordinated debt financing for companies of various sizes in both the primary and secondary markets. H.I.G. WhiteHorse is a leading manager of Collateralised Loan Obligations (CLOs) and maintains a listed business development company (WhiteHorse Finance).

H.I.G. real estate funds invest in properties that can benefit from improved investment management.

H.I.G. infrastructure funds focus on value-add and core-plus investments in the infrastructure sector.

Since its foundation in 1993, H.I.G. has invested in and managed more than 400 companies worldwide. The company’s current portfolio includes more than 100 companies with total revenues in excess of $53 billion. For more information, visit the H.I.G. website at hig.com.